USDA Loan Programs:

Introduction:

The Role of USDA in Rural Development

Rural areas have long faced challenges in accessing suitable financing options for their businesses and community development projects due to their remote nature away from population centers. To address this issue, the United States Department of Agriculture (USDA) introduced the USDA OneRD Guaran- tee Loan Initiative. The programs under this initiative serve as an alternative financing solu- tion, when utilized, empowering rural busines- ses to thrive and communities to flourish. This white paper aims to delve into the programs’ highlights, historical context, and eligibility criteria while exploring the transformative impact of the USDA loan initiative through real case studies.

Businesses with capital needs in the $15 to $50 million range may not qualify or cannot obtain financing through conventional, local, and regional banks. There are limited options to help solve financing gaps for these rural projects. The USDA OneRD Loan Initiative addresses these financing challenges that may otherwise hinder growth and limit access to capital.

Historical Context Of

USDA Rural Development Loan Programs

The USDA‘s commitment to rural development dates back to the early 20th century when the United States government recognized the need to support agricultural communities facing financial challenges. In 1933, the Resettlement Administration was established, which later evolved into the Farm Security Administration (FSA) in 1937. The FSA provided loans and technical assistance to struggling farmers, kickstarting the government‘s efforts in rural development.

In 1994, the USDA Rural Development (RD) agency was formed, consolidating various programs and initiatives under a single entity. Legacy USDA Rural Development loan programs aimed to enhance the economic well-being of ru- ral communities, including business de- velopment, infrastructure improvement, and access to essential services. As part of these efforts, the USDA OneRD Loan Initiative was introduced in 2020 to of- fer a comprehensive range of financing options tailored to the unique needs of rural businesses and communities.

The Four Flagship Programs

- Business and Industry Guaranteed Loan Program (B&I)

- Rural Energy for America Guaranteed Loan Program (REAP)

- Community Facilities Guaranteed Loan Program (CF)

- Water and Waste Disposal Guaranteed Loan Program (WEP)

Understanding

Rural Areas and Eligibility Criteria

Before delving into each loan program’s features, it is essential to highlight the USDA’s definition of a rural area. The agency classifies an area as rural if it lacks a significant population center or if its population is under 50,000. See this map to determine if your project is eligible. This applies specifically to OneRD loans offered by lending institutions. Other USDA programs may have a different calculation.

Eligibility criteria for the USDA OneRD Loan Initiative programs may vary, but generally include factors such as the size and nature of the business or project, the potential for economic development, and adherence to environmental regulations.

USDA OneRD Loans Versus Conventional Loans

| BENEFIT | USDA OneRD LOAN | CONVENTIONAL LOAN |

| Interest Rates | Competitive interest rates, which may be lower, or fixed for a longer period, than a conventional lender. | Interest rates may be higher and/or fixed for a shorter period of time than USDA OneRD loans. |

| Loan Amounts | Flexible loan amounts to meet the project needs. | Loan amounts may be constrained by legal lending limits or in-house exposures. |

| Loan Guarantee | Because of the USDA guarantee, lenders can offer more flexible underwriting parameters. | No loan guarantee is provided, therefore, lender credit criteria may be narrower. |

| Loan Terms | Flexible, fully-amortizing, loan terms of up to 30 years for businesses and up to 40 years for small towns, districts, and tribes. | Typically shorter terms with balloon payments. |

| Use of Funds | USDA has defined uses for funds but accommo- date most project types. | Lender may have internal lending criteria that restricts usage of funds. |

| Regulatory Barriers | The USDA has removed regulatory barriers to make it easier for private lenders to use loan programs to invest in rural businesses. | Regulatory barriers may make it more difficult for rural businesses to secure financing. |

Case Studies

Waterfall Resort Alaska & Steamboat Bay Fishing Club

Waterfall Resort Alaska & Steamboat Bay Fishing Club

Alaska is home to a diverse group of marine life, and its fisheries provide local jobs and a stable food supply for the country.

A short float plane ride from Ketchikan, there is a unique 55-acre fishing resort located in a remote rural expanse of wil- derness. With little development for miles, the resort employs many people. The attraction of its remote location to visitors, only accessible via air or sea, can also create financing challen- ges for similar properties.

One of the features of the USDA OneRD loan program is that it supports businesses with non-traditional operations and where local banks cannot provide the necessary funding to support their growth plans. Through the B&I Guaranteed Loan Program, the resort secured a $13.75MM long-term loan, allowing them to refinance the property while creating and sustaining jobs.

Business and Industry Guaranteed Loan Program (B&I)

The Business and Industry Guaranteed Loan Program aims to bolster economic growth and create jobs in rural areas by guaranteeing loans to eligible businesses.

Key features of this program include:

- Loan guarantees for businesses seeking to finance up to $25MM

- May be paired with any of the loan programs below with potential financing amounts of more than $100MM

- Support for various borrower types, including for-profit businesses, municipalities, cooperative organizations, and non-profits

- Focus on promoting rural businesses that con- tribute to sustainable economic development and community enhancement

Johnson County Special Utility District

Johnson County Special Utility District

Johnson County Special Utility District in Texas needed an increased capacity of its water storage to help meet the grow- ing demand of its users. The district serves three counties across 324 miles through approximately 900 miles of distribu- tion pipeline. One of the district’s responsibilities is planning and preparing for growing customer demand by expanding its systems and replacing aging infrastructure with modern distribution equipment for efficient operations. The district required funding for a new one-million-gallon water storage tank. Along with the tank, construction of piping to con- nect to the existing distribution network was needed. This additional capacity will allow greater resiliency and increased water supply for the district’s customers in this community.

By utilizing the Water and Waste Disposal Loan Guaranteed Program, the district received a $3.42MM loan, securing a long-term, low-rate solution to modernize the water storage infrastructure. This, in turn, ensures access to clean and safe drinking water for its residents and contributes to the district‘s continued growth and development.

Water and Waste Disposal Guaranteed Loan Program (WEP)

The Water and Waste Disposal Guaranteed Loan Program focuses on improving water and wastewater infrastructure in rural areas. A valuable community investment, water and sewer projects build the foun- dation for continued development in unserved and underserved regions across rural America. Access

to clean water, reliable service, and dependable infrastructure for both residences and businesses can be a challenge nationwide. Opportunities for capital to fund critical infrastructure support people living in rural America and create economic opportunity for communities.

Key features of this program include:

- Max loan amount of $50MM

- Up to 100% financing

- Loans for developing water and wastewater projects

- Support for projects that improve water quality, safety, and efficiency

Unity Medical Center

Unity Medical Center

Rural hospitals provide important services and contribute to the overall well-being of rural communities. They are signifi- cant as the health gap between urban and rural Americans continues to grow—given that rural residents are already at a higher risk of death from potentially preventable injuries and diseases than their urban counterparts.

Unity Medical Center in Manchester, Tennessee is a 49-bed facility that provides medical services to the surrounding community. It provides radiology, imaging, surgery, cardiolo- gy, and pulmonary care to the Manchester area. The facility required financing to support continued improvements since its non-profit conversion in 2019. The medical center secured a $21.25MM loan, utilizing the Community Facilities loan program, to refinance existing debt, purchase new medical equipment, and facility updates. Continued investment in this rural healthcare facility ensures access to critical services in the underserved area remains.

Community Facilities Guaranteed Loan Program (CF)

The Community Facilities Guaranteed Loan Pro- gram aims to improve essential community services in rural areas. Examples of essential community services are healthcare centers, schools, roadways, and public safety facilities.

Key features of this program include:

- Financing for community projects that enhance the quality of life for rural residents

- Support for public entities and non-profit organizations in building or improving facilities

- Focus on projects that promote community development, healthcare, education, an public safety

- Guaranteed loan amounts up to $100MM

- May be paired with USDA direct loans

- Up to 100% financing

Power Plant

Power Plant

REAP helps increase American energy independence by increasing the private sector supply of renewable energy and decreasing the demand for energy through energy efficiency improvements. These investments can also help lower the cost of energy for small businesses and agricultural producers over time.

A power plant required a loan for a renewable energy system that will convert an existing landfill gas to an electricity facili- ty to a landfill gas to a renewable natural gas facility. The pro- duced energy will also feed electricity into the electric grid. The new system will continue to capture harmful emissions and expects to convert those emissions into 500,000 MMBtu of renewable natural gas annually.

A total package of $45.8MM was executed that consisted of a short-term loan positioned for a permanent takeout by combined USDA Rural Energy for America and Business and Industry loans.

Rural Energy for America Guaranteed Loan Program (REAP)

The Rural Energy for America Guaranteed Loan Program promotes energy efficiency and renewable energy pro- jects in rural areas.

Key features of this program include:

- Financial assistance for energy efficiency upgrades and renewable energy installations

- Support for agricultural producers and rural small businesses to reduce energy costs

- Emphasis on projects that contribute to environmental sustainability

- Up to $25MM

Key Benefits of

USDA Financing for Rural Business and Communities

USDA Product Pairing Capabilities

Product pairing and capital stacking in financing, particularly when combining USDA financing with various other capital sources, can yield substantial results. This strategic approach enables the optimization of financial resources by lever- aging different funding streams, each designed to address specific needs and goals.

USDA financing provides a stable foundation, often with more favorable terms and rates, serving as the core investment into a project. When paired with C-PACE, organizations can unlock funds for sustainable energy-efficiency improvements, fostering both environmental responsibility and cost savings. Incorporating NMTC can infuse the project with fresh capital, rejuvenating underserved areas and sti- mulating economic growth. The inclusion of ITC not only promotes clean energy adoption but also substantially reduces overall project costs. Lastly, TIF bolsters development by earmarking future tax revenues to fund present investments.

Through effective capital stacking, these diverse financial instruments synergize, creating a comprehensive solution that not only diversifies risk but also maximizes returns, fostering holistic progress, innovation, and sustainable development in communities while propelling businesses toward greater success.

One of the benefits of USDA financing is its ability to effectively pair with other capital sources to create effective capital stacking:

- Commercial Property Assessed Clean Energy (C-PACE)

- New Markets Tax Credit (NMTC)

- Investment Tax Credit (ITC)

- Tax Increment Financing (TIF)

- USDA Grant Opportunities

California Custom Processing

California Custom Processing

California Custom Processing (CCP) is a custom processor of almonds for domestic and global customers that produce bakery, snack, confection, dairy, and plant-based consumer products. CCP required capital to refinance existing debt, construct an adjacent facility, and install a renewable energy system for their Madera (CA) facility.

The current CCP almond processing facility is 65,000 square feet. The company sought financing to cons- truct an adjacent 52,500-square-foot processing building to support business growth.

The company secured a combined financing package of $33.5MM comprised of a $29.5MM USDA OneRD loan and a $4MM Commercial Property Assessed Clean Energy Assessment (C-PACE) financing through the California Statewide Community Development Authority(CSCDA) – Open PACE program that will fund the renewable energy system.

CCP will be increasing its sustainability with a roof-mounted solar array for its current facility and will build seismic resiliency in the construction of its expansion. The new facility will allow CCP to increase custo- mers’ intake by 30% while leveraging a steam generator for the blanching (removal of almond skin), scalding, processing, and pasteurizing raw almonds. The solar steam generator emits zero carbon 100% during daylight hours, with an estimate to reduce carbon emissions overall by 25% – 35%.

California currently produces 80% of the world’s almonds, and cleaner processing positively impacts the environment.

Funding Rural America‘s Future

Conclusion

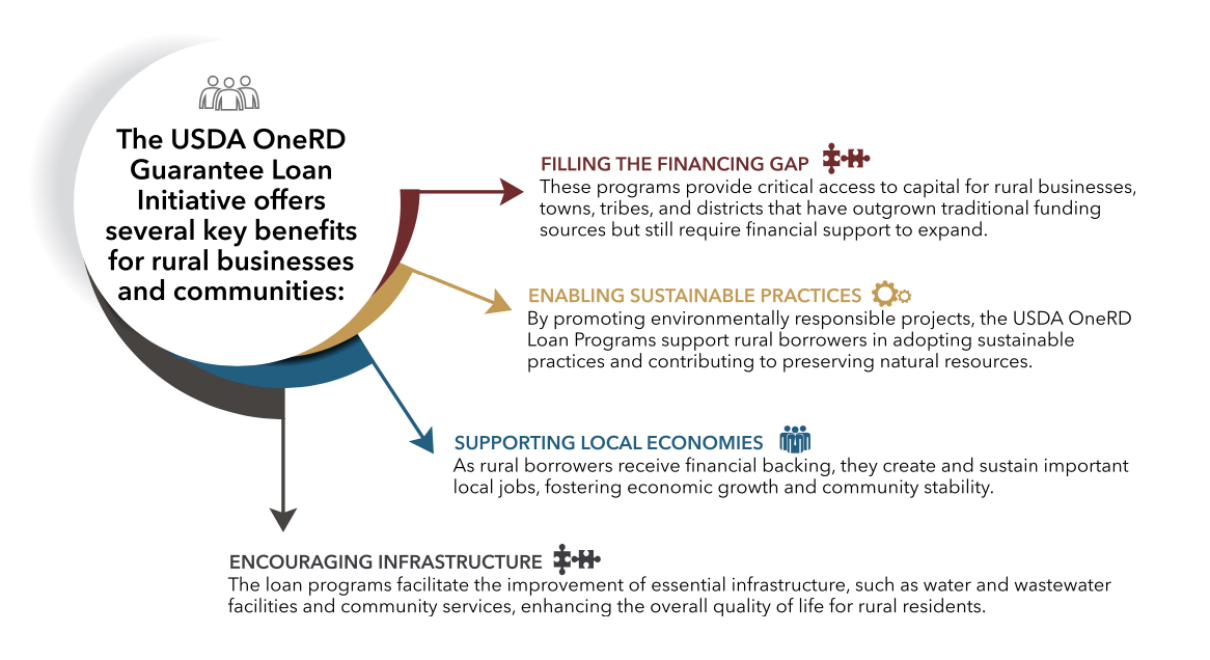

The USDA OneRD Guarantee Loan Initiative has proven instrumental in providing rural businesses and communities with the necessary financial opportunities to thrive and prosper. By bridging the financing gap, supporting sustainable practices, and bolstering local economies, these loan initiatives play a significant role in fostering rural development and play an important role in supporting rural America.

For more information and to learn if your project qualifies for one of the programs, contact info@xrcusda.com.

Following is a list of other resources for you to explore about the USDA OneRD loan programs.

- https://www.rd.usda.gov/sites/default/files/OneRDLenderGuide.pdf

- https://www.rd.usda.gov/onerdguarantee

- https://www.rd.usda.gov/sites/default/files/fact-sheet/508_RD_FS_RBS_BIGuarantee.pdf

- https://www.rd.usda.gov/taxonomy/term/6962

- https://eligibility.sc.egov.usda.gov/eligibility/welcomeAction.do?pageAction=ONERD

- https://www.usda.gov/media/press-releases/2020/08/31/usda-implements-onerd-guarantee-loan-initiative-encourages-private